Worries regarding Winter Supply

We ended last week’s market update with the sense that there was volatility and bullishness to come across the Market; that proved to be entirely correct as Offers surged during the week in an extremely volatile couple of trading sessions.

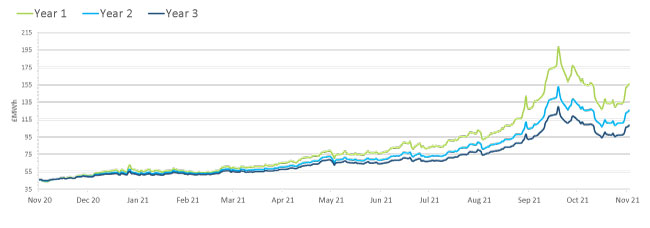

Electricity Market

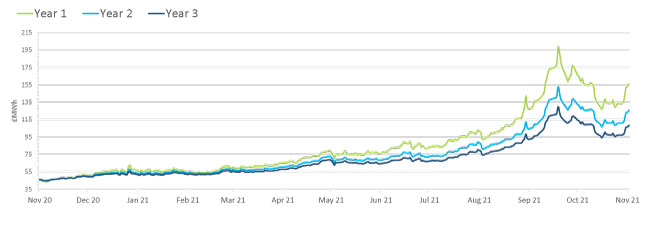

Worries regarding Winter Supply have been around since April/May however we are now staring down the barrel of Winter with temperatures set to drop considerably into next week; therefore this week’s Russian Gas Auction was of particular interest to markets. The monthly gas transmission capacity auction on Monday revealed no additional capacity bookings into Western Europe, a considerable blow to supply which resulted in a near 6% rise on December delivery offers.

Gas prices increased further and strongly throughout Tuesday with December delivery offers increasing by over 17%, supported by the German Energy Regulator (Bundesnetzagentur) to suspend the procedure to certify Nord Stream 2 AG as an independent transmission operator, which brings increased uncertainty over when the pipeline will begin commercial operations, with some now speculating that the pipeline may not be operational until March/April 2022 if approved by the EU Commission.

Gas Market

Since Wednesday the volatility has lessened with markets now looking for a clear direction of travel. Asian LNG Prices have seen some eye-watering increases this week, with a 25% increase, which could attract much needed European Cargos to re-route to Asia; that being said there are 10 deliveries into North West Europe scheduled in the coming days with a regas volume of 1065mcm.

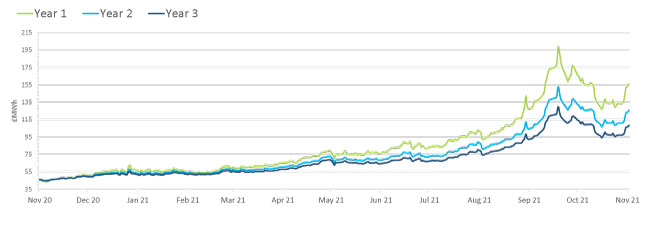

Power prices tracked the bullishness of Gas Markets, with some significant increases across the curve, with the January 22 delivery posting an eye-watering increase of £27.25/mWh increase on Tuesday alone. So far this week the Winter Electricity Prices have been incredibly bullish with the following applying:

Dec 21: +48.30£/mWh (+181.63 since this time last year)

Jan 22: +46.24£/mWh (+201.21 since this time last year)

Feb 22: +57.36£/mWh (+190.65 since this time last year)

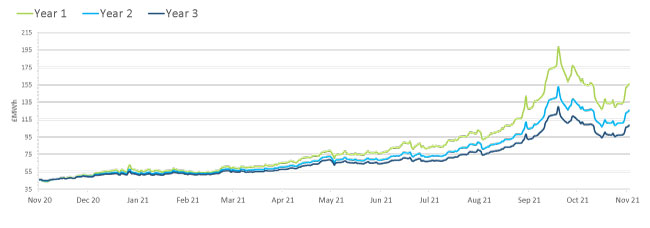

Carbon Markets

Additional pressure is being felt on Carbon Markets, where it is a case of another day – another all time high, as the wider energy complex pushes offers higher and higher. It could be argued that Dec 21 EUA’s are slightly overbought, however there does seem to be a growing sense that offers could climb over the €70/t threshold and even touch €75/t by the end of this year; which is staggering considering that at this point last year Dec 21 EUA’s were trading around €20-25/t.

Cold Blast Expected

With temperatures set to drop considerably next week we are likely to see markets head in a bullish direction, with keen eyes focusing on Russian and Norwegian spot flows with both being stable yesterday and today after what was a shaky start to the week especially on the Norwegian side, with supply still impacted by the unplanned outages at the Karsto gas processing plant and the Sleipner and Oseberg fields.

Oil Prices

Oil Prices have fallen, but remain high and there is a sense that this dip is only temporary, indeed the US and China have openly discussed utilising their vast Strategic Oil Reserves to cool markets; but there seems to be little support from other countries with Japan and South Korea declining the invitation from President Biden. As things stand, markets look to be heading in the upward direction in the short term with little or no help on the horizon.

For further information on energy markets, help or support contact us on Tel. 024 76630 8830 or email @ sales@getsolutions.co.uk

#energy