News

Insight is power

Energy Market Update for October 2015

Our latest energy update providing insight into market trends

for gas, power & oil, and what to watch throughout the month.

Market Summary

Gas – Prices increase month on month as higher winter demand approaches

Power – The power market edged up on higher fuel costs

Oil – The oil market struggled to provide any clear direction, as declining US crude production is offset by lower expected oil demand

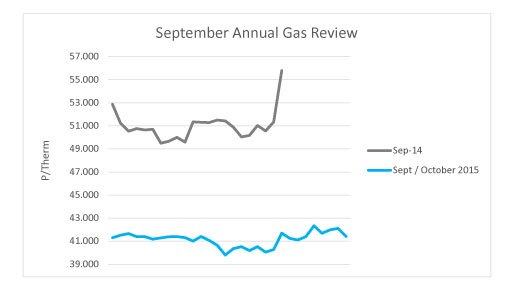

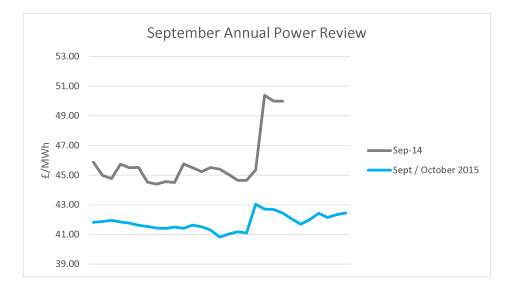

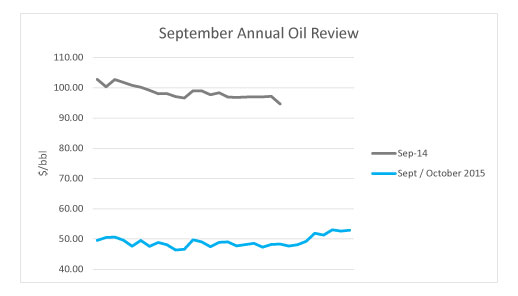

Direction of Market Price (September 2014-2015)

Gas

Gas prices increased throughout August and September, as domestic gas demand was forecasted to increase as winter got closer. Norwegian gas production and LNG cargo deliveries boosted supply capacity throughout September, limiting the effect of higher expectations of gas demand, which eased October gas prices.

Britain will continue to receive more gas supply during October and thanks to higher than usual LNG Cargo deliveries, should be able to provide supply flexibility over the course of this month.

Further supply outlook continues to remain healthy due to high storage however, the looming winter weather and forecasted seasonal normal temperatures will bring higher demand over the coming months..

Power

When gas price increases, the expected cost of generating electricity from gas also increases, which immediately supported upward movement in the power market.

As temperatures drop to seasonal normal throughout October, there is a risk that gas fired plants will be needed to keep up with electricity demand providing upward support across both commodity markets. Upwards support also came in addition from a weaker sterling – euro exchange, increasing the cost of importing gas from Europe. Lower coal prices, which would reduce the expected cost of generating electricity from coal, did very little help the market recover from previous months gains.

Oil

Oil prices narrowly increased during September, as the upward momentum from August is beginning to fade. United States oil output has been declining since mid-June as low oil prices have inevitably lowered production. Prolonged low oil prices have also meant that banks are increasingly cautious in funding operations that have a high risk of generating adequate returns. At the moment, World oil production remains relatively high; this should limit any upward pressure on oil prices.

In September, the US Federal Reserve (FED) decided to keep interest rates unchanged, taking in to consideration recent global macroeconomic concerns – China’s economy is showing signs of slowing and Europe continues to face economic growth difficulties, all of this will probably continue to limit the expected demand for Oil.

What to watch out for throughout October:

Concerns over the Chinese economy have now started to trigger concerns about Asian demand growth. Any developments linked to the health of the Chinese economy could influence and impact commodity markets.

Any signals coming from the United States on whether an interest rate rise will take place this year. The likelihood of an interest rate hike in 2015 should increase the relative strength of the US dollar, which will reduce the appetite for commodity growth demand, especially amid weak Asian demand growth.

A rare meeting of OPEC and Non-OPEC (Oil) producers has been set for October 21st in hope they will find an agreement to support the oil market in light of low demand amid high supply.

There has also been speculation that Russia’s energy minister and Saudi Arabia have arranged a meeting to suggest ways of tackling low oil prices.

Topics of Interest: