News

Insight is power

May Market Snapshot

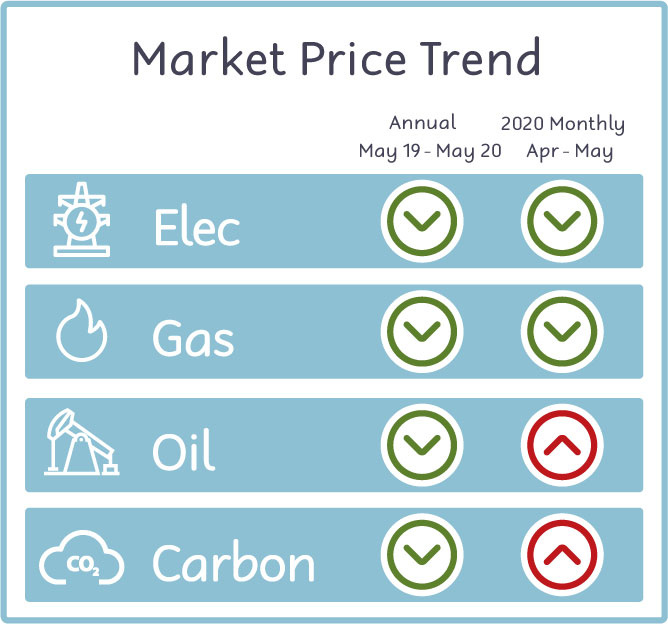

Movements within the wholesale energy market can have a significant impact on the price a business will pay for their electricity and gas. The effective unit rate a business pays, includes the commodity cost (the cost of the energy that is consumed) and the third party charges which include but are not limited to Climate Change Levy (CCL), Renewables Obligation (RO), Feed in Tariffs (FiT), plus other transportation, and maintenance costs. The commodity costs account for circa 45% of an electricity bill and 65% of a gas bill. For further details regarding effective unit rates, please get in touch.

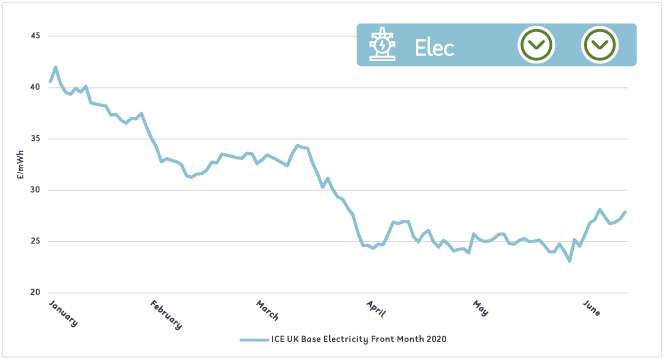

Electricity prices continue to fall slightly in May despite early signs of recovery.

Electricity prices continue to fall slightly in May despite early signs of recovery.

The resulting low demand from lockdown and falling gas prices has been the main influencing factors on the continued downward trend of electricity prices through May. However, this slight circa 3% fall could have been significantly more had the economic outlook not improved and the cost of carbon not picked up

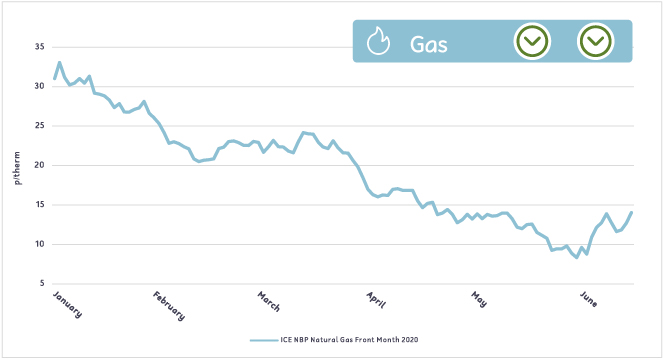

Low demand & perhaps our sunniest May have kept gas prices tumbling.

Record European gas storage levels and low demand have contributed to the steady fall in gas prices as they hit 20-Year record lows of circa 35% by the end of the month.

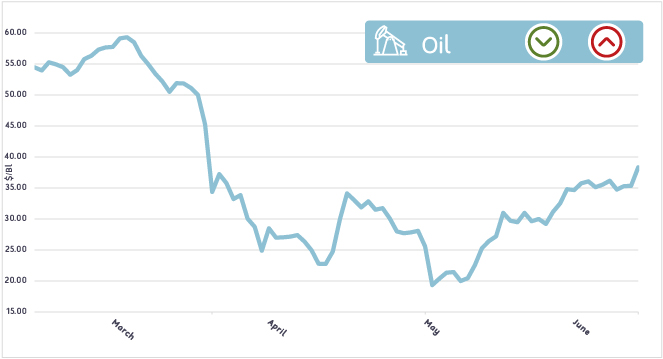

Oil prices steadily recovered throughout May following record low end of April prices.

Oil prices steadily recovered throughout May following record low end of April prices.

A further cut to OPEC+’s (Organization of the Petroleum Exporting Countries) oil production in June by another 1 million barrels per day helped prices increase. This is conjunction with a drop in US production, the weakness of the US dollar and signs of oil demand increasing as lockdown eases has led to an increase of nearly 40%.

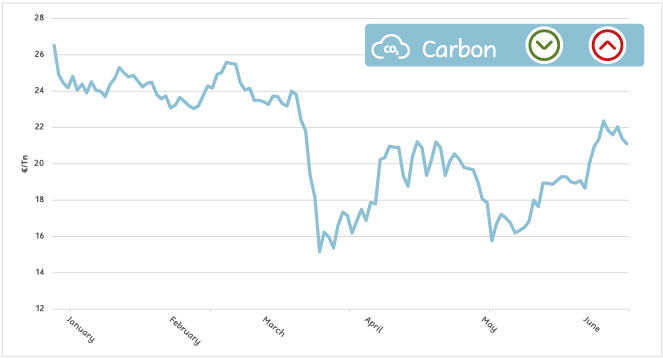

Carbon prices have been increasing over two consecutive months despite a fall at the end of April.

With lockdown restrictions being lifted in several countries, the resulting improved economic outlook has had a positive effect on carbon with prices rising by approximately 8%.

On the horizon:

May has been a good month for wind and solar generation, however as temperatures start to climb, the price of electricity is also expected to rise as we turn to air-conditioning and demand increases.

Another OPEC meeting is expected in June and the outcome could affect oil prices. Markets are expected to recover as economies start to reopen following Covid-19, however, this recovery could be marred by the fear of a potential second wave of infections and further hampered by the differing recovery rates of economies around the globe.

Click here for our detailed energy & markets report