Kieran’s Corner

Partner Channel Market Analysis

Market Watch Week Commencing 3rd April

The countdown to the UK’s withdrawal from the European Union has now begun after Prime Minister Theresa May triggered Article 50 last week; attention now turns to the exit deal that can be reached and the implications it may/may not have to the UK.

There are likely to be battles on a number of fronts; Scotland, Gibraltar, Immigration and the prospective openness to the Single Market, which will no doubt cause volatility on Stock Markets and Currency Markets over the next year or so.

The first meeting between US President Trump and Chinese Counterpart Xi Jinping will take place this week, as the Chinese Premier travels to Florida for talks on Trade, the South China Sea and possibly most importantly North Korea. Prior to the visit, Mr Trump has placed North Korea at the heart of the agenda issuing China an ultimatum demanding the superpower pressure North Korea into dismantling its nuclear programme or the US would intervene on its own.

There was good news for the FTSE, as it closed Q1 up 2.8%, completing a 4th straight quarter of gains; its best winning streak since 2011 fuelled mostly by a weak pound.

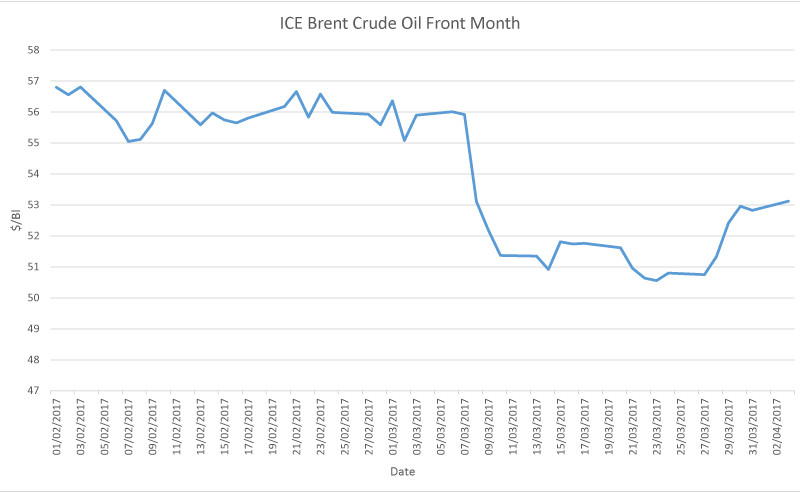

Mini comeback for Oil prices

Oil Prices have staged a mini comeback of the last week, thanks in part to a weak dollar. However Libyan Production is starting to play with markets. From 2013 and the Arab Spring, Libyan Oil Production has fluctuated massively between 200k b/day and 1m b/day resulting in uncertainty within OPEC when it comes to supply forecasts, Since the start of the year it had been hoped that Libyan Production would increase to pre-2013 levels with some pleasing results towards the end of 2016, however new supply distributions came to the fore last week as protestors blocked two separate fields leading to a shutdown in production.

Talks are ongoing between OPEC and Non OPEC members regarding an extension of the Output Cut; Iran and Russia met last week, with Iranian Oil Minister Mr Bijan Namdar Zangeneh commenting that “a global deal is likely to be extended” however there was little comment regarding a cut in Iranian Production.

The Baker Hughes Rig count showed another increase in US Rigs, up 10 to 662; limiting any further gains on the week. It does reinforce the feeling that the US is ready to take advantage of higher Oil Prices and boost its shale production.

Healthy supply & demand

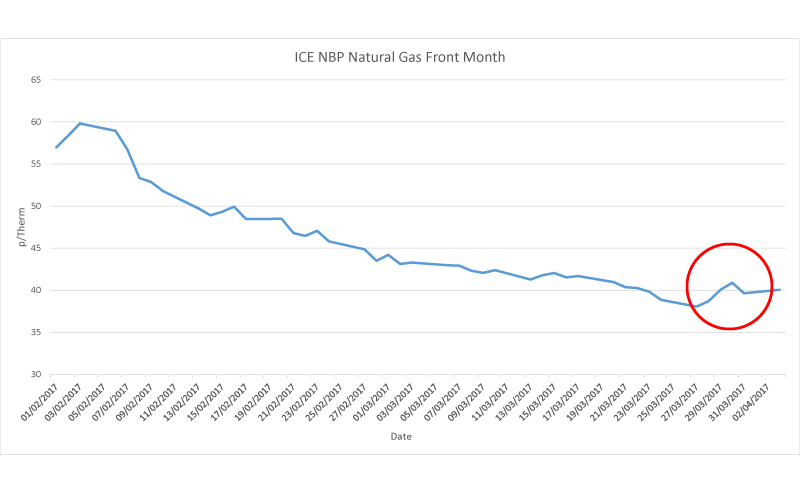

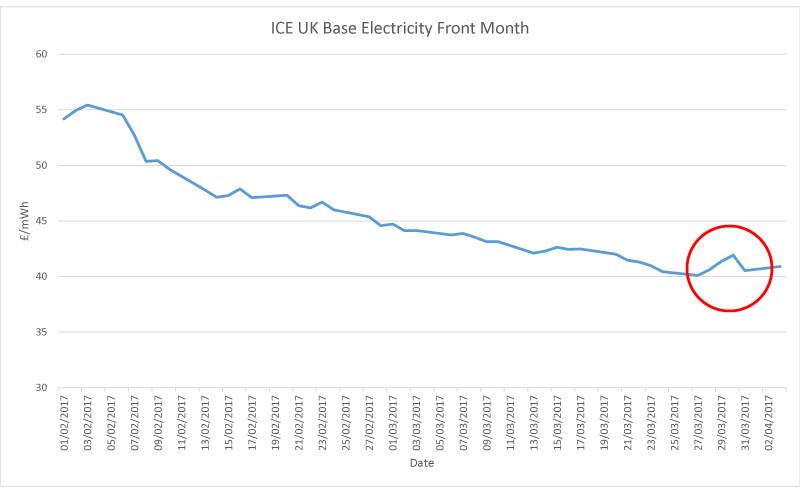

Since the start of February, Gas and Electricity offers have decreased significantly thanks to the strengthening of the British Pound and prospects of milder weather to come. However, over the course of last week we have seen jitters in the market, where a spike in the market, led by increases in Oil Prices, stunned many market participants.

An undersupplied system towards the latter part of the week helped to heap more upward momentum on offers. The vast amount of the increases were felt on Gas Markets but eventually filtered in to Electricity offers, with an increase of 2.11% on Front Month Electricity. Gas offers rose by nearly 4% forcing many suppliers to issue new matrices.

The fundamentals of Supply and Demand still look healthy for Gas and Electricity which may help to limit potential increases in the medium to long term.

It is expected that Prices will increase further at the start of this week, thanks to a steep rise in Coal Prices because of production worries in Colombia following a devastating mudslide, it is unclear when production will recommence so it is certainly a case of wait and see. We may see significant volatility in Oil and Stock Markets as the historic meeting between Mr Trump and Mr Jinping takes place in Florida Today.

Click here to request a pdf copy of this week's report