Kieran’s Corner-last update

Partner Channel Market Analysis

Market Watch Week Commencing 27th March

Prior to his inauguration in January 2017, Mr Donald Trump had set his sights on the reform of ‘Obamacare’, repeatedly commenting throughout his Presidential Campaign that he would break what was one of Mr Barack Obama’s most prized reforms of his Presidency.

The defeat of Mr Trump this week was a huge blow to his Presidency as it is clear that although his Republican Party have a majority there are still divisions within it. Because of this defeat, markets are nervous about the possibility of the Trump Administration failing to push through the market friendly Tax Reforms, with the record highs that the Dow Jones reached early this year being eaten into slightly.

Furthermore, reports published last week saw US Existing Home Sales down by 3.7% in February and, for the first time since 2013 House Prices stalled. Although Chinese House Prices have stalled since the start of the year, it is important to note that the Government Intervention there, had seen prices stall in what was a booming market – tighter credit regulations and increases in the minimum deposit have been used to cool the overheated market, so comparisons between US and Chinese Housing Markets would be unwise, but it does seem that the honeymoon period for the 45th President may be over.

Oil markets stutter

The Oil Market has yet to recover from its mini crash in the early part of this month, with the market remaining in a very delicate state.

An awful lot of speculation surrounds the next OPEC meeting on May 25th in Vienna where it is possible that an extension on the Output Cut would be set in place. What is unclear is the participation of Non-OPEC members such as Russia – latest figures from Rosneft indicate that the reduction target of 300kbd has yet to be reached, with the figure hovering around 161 kbd just over half the agreed amount.

OPEC need co-operation from Non-OPEC Members, as US Production continues to rise with latest figures showing Crude Oil Inventories increasing by 5m barrels last week, a 6.3% increase on the same period last year, and on the demand side there was a slight uptick with a 0.5% increase on the same period as last year.

In addition to these figures, the US Rig Count produced by Baker Hughes showed another increase last week with 21 additional Oil Rigs added bringing the total to 652. If the conclusion of the existing Output Cut shows that only a handful of participants met their obligations, it is hard to envisage an extension agreement would be met. We may see increased volatility as we edge closer to May 25th.

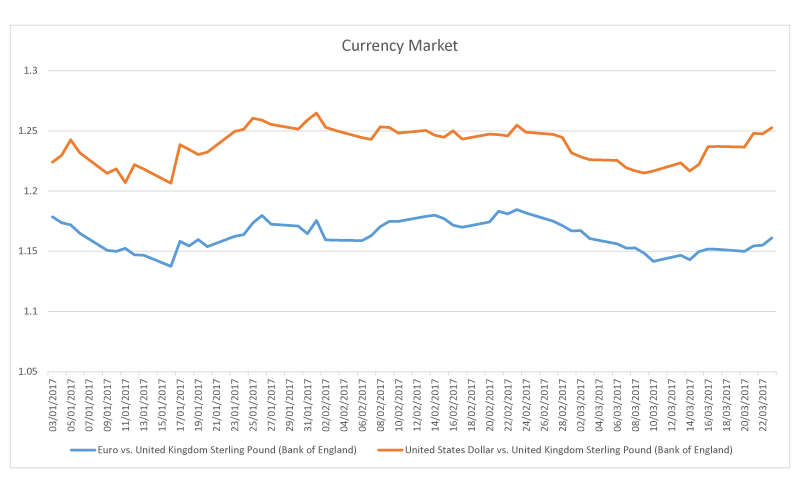

Pound proves resilient

The returning strength of the British Pound over the last week or so has been one of the most positive influences on Gas & Electricity prices. Inflation figures released have given a boost to the currency that severely under performed in 2016. Additionally, one member of the BOE called for an immediate Interest Rate Hike, whilst this is unlikely to occur in the current political context, it is uplifting to hear that there is the feeling within the BOE that Interest Rates may be looked at in the future.

It is safe to suggest that we may have got through the worst of the winter, temperatures are rising slowly and the nights are starting to draw longer easing demand slightly.

In addition, Coal prices, have fallen sharply over the last few weeks thanks to an announcement from China stating their will be no major cuts to production, fuelling fears of an oversupply in the market.

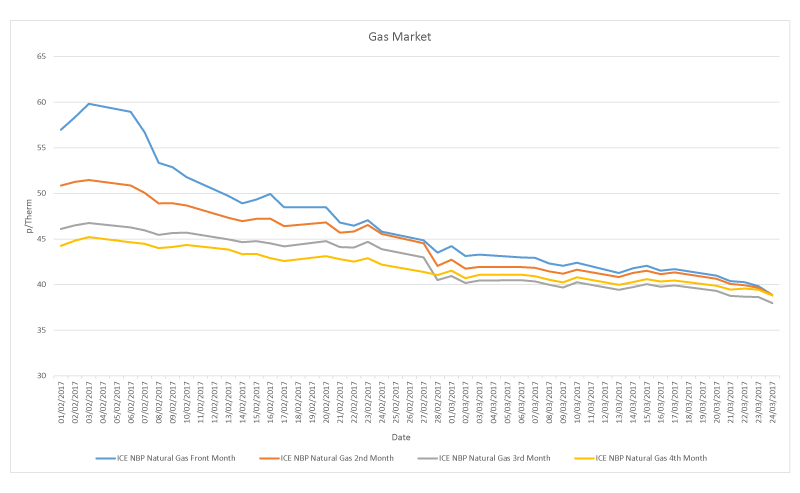

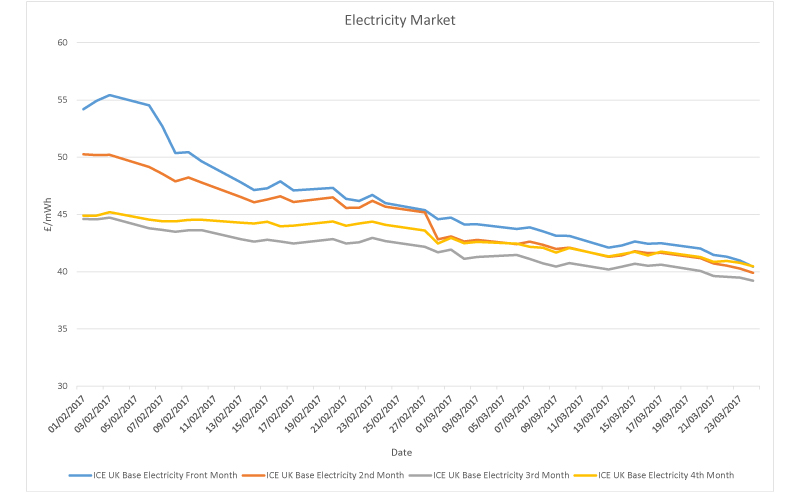

Calming Energy Markets

In addition to Gas and Electricity offers being helped by the strength of the British Pound, a slight decline in demand as milder weather starts to return, and a reduction of Oil Prices has most certainly helped.

As a result, Electricity Front Month offers have reduced by 9.94% since the start of this month whereas Gas Front Month offers have reduced by 12.26% over the same period, forcing many suppliers to withdraw their matrices and release cheaper models.

It is likely that offers will continue to draw lower over the course of the week with very little in the way of Economic Reports due to be released. The main report is likely to be the US GDP report on Thursday where the consensus points to a 0.1% increase from the previous report (1.9%). It may prove to be the start of an easier period for Gas and Electricity offers over the next week or so.