News

Insight is power

Energy Market Update for October 2016

Energy Market Report

Friday 30th September was a good day for policy makers, figures released from the Office of National Statistics showed an expansion of 0.4% in July for the UK’s service sector; a sector that makes up the bulk of the UK GDP, forcing a revision of the Q2 GDP figure to 0.7% from 0.6%.

This figure does show that post Brexit; consumer’s mind-set did not change; it may also point to the consistently warm temperatures we experienced during July. This figure however, was forgotten as the weekend wore on with the announcement from Prime Minister, Mrs Theresa May, that Article 50 of the Lisbon Treaty was to be invoked, therefore getting the British ‘divorce’ from Europe underway by March 2017.

This will do little to help the value of the British Pound, which has been under significant downward pressure for some time, losing over 11% against the Euro since the referendum result. In turn, this effects our Gas Prices, forcing them upwards as we import a chunk of our Gas supply from the continent.

Gas Prices are also very reliant upon Oil Prices, which have finally broken the $50 /bl mark after the OPEC Meeting last week, the announcement that a production cap was on its way was aided by a reduction in US Crude Oil inventories of 1.9m barrels, forcing a rise of $3 /bl.

More increases were limited after the Baker Hughes Rig count showed an increase of 35 rigs in North America to 684, however it is important to note that year on year that figure is down by 287 – a sharp reminder of how damaging low Oil prices have been over the course of 2016.

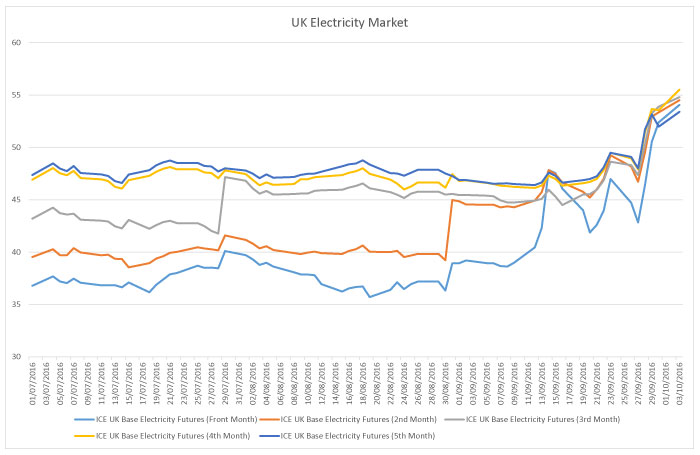

Electricity offers have been extremely volatile over the last few days, with a number of suppliers pulling their matrices. Whilst we can look to increases in the Gas and Oil Markets for a portion of the blame we must also turn our heads towards the continent and see what is going on with European Electricity Prices.

Due to lack of availability at its nuclear sites, French Power offers surged to a 13 Month High, having a knock on effect with other European Electricity offers.

A number of nuclear sites with steam generators in France are under investigation after reactor pressure vessels and their caps, contain a very high level of carbon, forcing the steel framework to potentially become brittle. These investigations may cause outages and disruptions as there is a potential for catastrophe, if the issues are not rectified quickly and correctly.

As a result, our Electricity offers are nearing a backwardation level and have increased violently over the last week or so, with an increase of 11.53 £/MwH or 26.92% over the last 9 days as can be seen on the graph below:

When in a rising market it is important to note that urgent action is needed at some point, therefore it is not advised to bury heads in the sand and wait for the ‘storm’ to pass. Take action and but please keep an eye on the market.

To protect your utility costs from rising markets, contact us